Andrew Buchanan

Historically, sustainability reporting has been inconsistent and fragmented, with companies being able to choose from a range of voluntary frameworks which have differing requirements and have been applied inconsistently. This has led to greenwashing, and calls from users of corporate reports, regulatory authorities and others for the development and consistent application of comprehensive and robust reporting requirements.

The past two years have seen significant and rapid progress in sustainability standard setting. Companies in many jurisdictions worldwide will be required to publish sustainability reports, some sooner than others (particularly in the European Union, where an assurance report – initially providing limited, but ultimately reasonable, assurance will also be required).

Starting with global developments, at the IFRS Foundation a new International Sustainability Standards Board (ISSB) was formed towards the end of 2021 and, at the end of June 2023, the first IFRS Sustainability Disclosure Standards (IFRS SDS) were published. Rather than being entirely new, these standards have been developed using existing sustainability reporting frameworks and standards as a basis from which a global baseline of requirements can be developed, including the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and standards developed by the Sustainability Accounting Standards Board (SASB). This means that companies that already publish sustainability reports in accordance with existing standards and frameworks will not need to make fundamental changes.

A few weeks after their publication, the IFRS SDS were endorsed by the International Organisation of Securities Commissions (IOSCO). IOSCO called on its members in 130 jurisdictions worldwide, and representing 95% of the world’s capital markets, to consider how they can incorporate the ISSB Standards into their respective regulatory frameworks to deliver consistency and comparability of sustainability-related disclosures worldwide. This is important because, although the IFRS SDS have an effective date of annual periods commencing on/after 1 January 2024, the ISSB cannot require any jurisdiction to apply its standards. Instead, jurisdictions need to decide whether and when to require companies to report in accordance with them.

This endorsement of the IFRS SDS by IOSCO echoes its similar endorsement of IFRS Accounting Standards over 20 years ago, which are now mandatory in over 140 jurisdictions worldwide. For the IFRS SDS, multiple jurisdictions have already signalled that they will adopt them as a global ‘baseline’ to which they may add further jurisdictional requirements, including Australia, Canada, Hong Kong, Japan, Singapore and the United Kingdom. Some of these jurisdictions have indicated that they will require application of the standards in the relative short term.

Elsewhere, the US Securities and Exchange Commission published a proposed rule for climate-related disclosures in March 2022 and we are expecting a final rule later in October of this year. These are expected to be applicable to both domestic and foreign registrants, with significantly enhanced disclosure requirements. Certain aspects of the SEC’s proposals are similar to the TCFD, which formed the basis for the ISSB’s standard for climate-related disclosures. Also in October, based on the SEC’s forward agenda, we are expecting to see a proposed rule for human capital management disclosures.

However, some of the most far-reaching changes to sustainability reporting requirements, with an accelerated timetable for their introduction, are in the European Union, where the final parts of the legislation are in the process of being put in place.

The overarching legislation is set out in the Corporate Reporting Sustainability Directive (CSRD), which very significantly widens the scope of companies that will have to publish sustainability reports. These reports will need to be prepared in accordance with the requirements of newly developed European Sustainability Reporting Standards (ESRS). In addition, companies that are within the scope of the CSRD will also need to report in accordance with the EU Taxonomy, which requires the percentage of revenue, capex and opex that meets certain sustainability-related criteria to be reported.

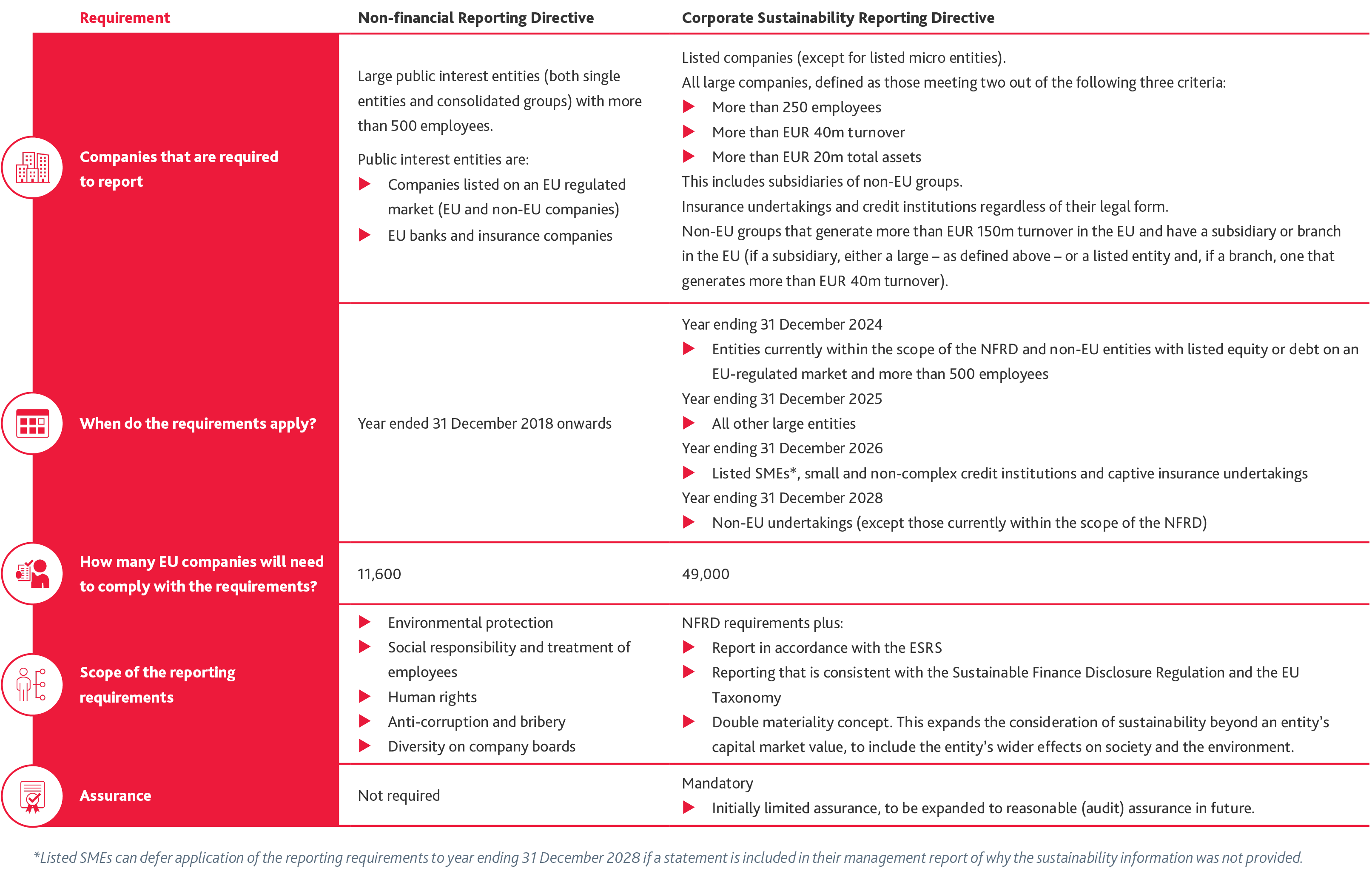

A summary of key changes introduced by the CSRD and their timing is set out below:

What’s the scope and how does it compare with current requirements?

The current Non-Financial Reporting Directive (NFRD) applies only to large public interest EU entities with more than 500 employees that are either listed on an EU regulated market, or are EU banks and insurance entities. The CSRD widens the scope enormously to include all entities listed on an EU regulated market (except micro entities), all companies that are classified as large (listed or private, including subsidiaries of non-EU parent companies), all insurance and credit undertakings, and non-EU groups which generate more than EUR 150m of revenue from sales to customers located in the EU and have either a subsidiary which is a large company or a branch which generates more than EUR 40m of revenue.

When do the new requirements apply and how do they apply to non-EU entities?

The requirements will be phased in over time. Entities that are currently within the scope of the NFRD will have to apply the new requirements for their 31 December 2024 year ends. However, in addition, non-EU entities that have either equity or debt listed on an EU-regulated market and have more than 500 employees will also be scoped in – and these companies were not within the scope of the NFRD.

The biggest change comes for 31 December 2025 year ends, when all other large EU entities will be in scope. 2026 brings in listed SMEs, together with small and non-complex financial institutions and captive insurers. However, listed SMEs could defer the adoption to their 31 December 2028 year ends, provided a statement of why the sustainability information has not been provided is included in the management report.

Non-EU entities are brought in from their 31 December 2028 year ends, with the large EU subsidiary or branch being required to obtain a sustainability report covering the entire consolidated group (with other reporting requirements being applicable if the ultimate parent company refuses to provide the information). Additional disclosures are required if the sustainability-related risk and opportunities of the group and the subsidiary are significantly different. The group level report will have to be subject to the same assurance requirements (limited or reasonable assurance) that would be required if the parent entity was an EU entity.

However, there is a transitional rule under which the non-EU entity reporting requirement can be satisfied by the largest EU subsidiary that is within the scope of the CSRD publishing a consolidated sustainability report that covers all in-scope EU subsidiaries. This transitional rule is available until 31 December 2029 year ends.

What reporting standards apply?

The CSRD requires sustainability reports to be prepared in accordance with ESRS. The first 12 of these have been finalised, with there being two cross cutting standards (general requirements and general disclosures), together with 10 standards (five for environmental topics, four for social topics and one for governance). There are almost 100 overall disclosure requirements with around 1,100 data points. Some of these are required regardless of materiality; others are subject to materiality (although if climate-related disclosures are considered immaterial a detailed explanation is required of why not), with some being optional.

How does materiality work?

The ESRS are based on the concept of double materiality. This means that in addition to consideration of the effects of sustainability-related matters on the reporting entity, it is necessary to consider the effects of the entity on society in general and the environment.

Are there any reliefs in the first years of reporting?

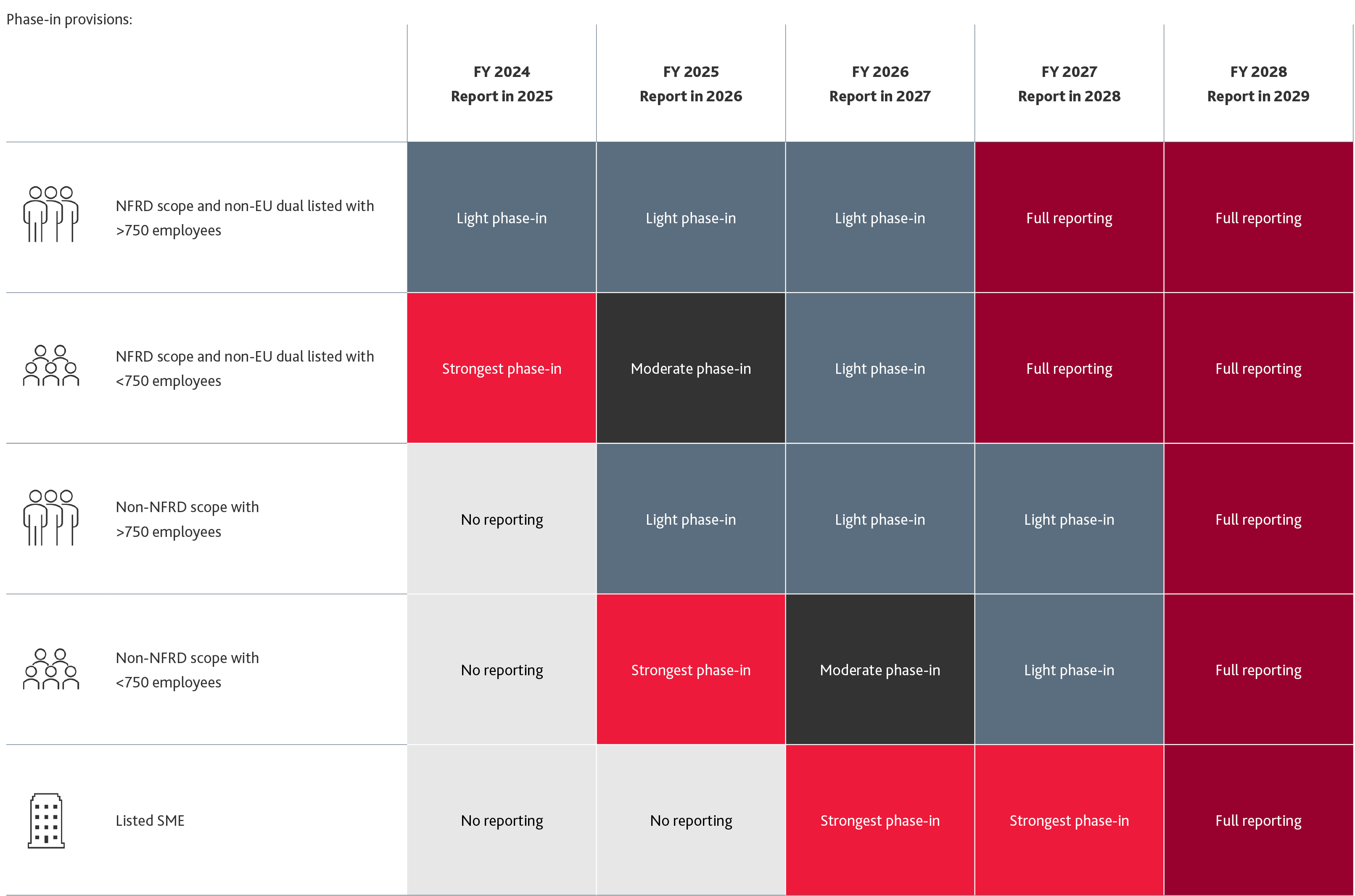

There are some transitional reliefs, the applicability of which depend on whether the entity was previously within the scope of the NFRD (or is a non-EU entity with equity or debt listed on an EU-regulated market), and whether it has more or fewer than 750 employees. There are also specific reliefs for listed SMEs.

Reliefs for all companies/groups

Disclosure of anticipated financial effects under pollution, water, biodiversity and resource use / circular economy can be deferred to the second year of reporting, as can certain social indicators (e.g. people with disabilities).

In addition, for the first three years of reporting, there is an exemption from disclosures about an entity’s value chain if the information cannot be obtained. However, this would require disclosure of why the information cannot be obtained and what is being done to obtain the information in future.

Reliefs for companies/groups with fewer than 750 employees

Disclosure of scope 3 emissions and compliance with ESRS S1 Own workforce can be deferred to the second year of reporting, with a further year being allowed for the adoption of ESRS E4 Biodiversity and ecosystems, S2 Value chain workers, S3 Affected communities and S4 Consumers and end users.

The phase in provisions are illustrated below:

The phase-in provisions might appear to bring significant relief to reporting requirements. However, even with the reliefs these will remain comprehensive and many companies, in particular those which have not previously been required to prepare sustainability reports in accordance with the NFRD, may struggle to comply. In addition, the thresholds for the timing of applicability of the CSRD, and for the availability of phase-in reliefs, are different meaning that the assessment of what is mandatory when can be complex.

Conclusion

Whether an entity is in the EU or elsewhere, the direction of travel is clear – mandatory requirements for sustainability reporting are coming, and they are going to arrive sooner than many are expecting.

In addition, even entities that are not brought into the scope of mandatory sustainability reporting are likely to have to do some work, because they will be somewhere in the value chain of an entity that does have to report. Already, even without mandatory sustainability reporting, we are seeing entities asking their suppliers for their sustainability credentials and, if these are not sufficiently well developed, business is being taken elsewhere.

Andrew Buchanan